10-Q: Quarterly report [Sections 13 or 15(d)]

Published on August 13, 2025

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

| QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

| For the quarterly

period ended |

|

| or | |

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ______________to _______________.

Commission

File Number:

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

Pelthos

Therapeutics Inc.

(Address of principal executive offices) (Zip Code)

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading symbol(s) | Name of each exchange on which registered | ||

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports),

and (2) has been subject to such filing requirements for the past 90 days.

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant

to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that

the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ |

| Smaller

reporting company |

|

| Emerging

growth company |

If

an emerging growth company, indicate by check-mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐

The number of shares of the registrant’s common stock outstanding as of August 8, 2025 is .

PELTHOS THERAPEUTICS Inc.

QUARTERLY REPORT ON FORM 10-Q

For the quarter ended June 30, 2025

PART I: FINANCIAL INFORMATION

Item 1. Financial Statements

PELTHOS THERAPEUTICS INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

| June 30, 2025 | December 31, 2024 | |||||||

| (Unaudited) | ||||||||

| ASSETS | ||||||||

| CURRENT ASSETS | ||||||||

| Cash | $ | $ | ||||||

| Prepaid expenses | ||||||||

| Due from Chromocell Corporation | ||||||||

| Deferred offering costs | ||||||||

| TOTAL CURRENT ASSETS | ||||||||

| TOTAL ASSETS | $ | $ | ||||||

| LIABILITIES AND STOCKHOLDERS’ DEFICIT | ||||||||

| CURRENT LIABILITIES | ||||||||

| Accounts payable and accrued expenses | $ | $ | ||||||

| Accrued compensation | ||||||||

| Loan payable, net of debt discount | ||||||||

| Loan payable - related party, net of debt discount | ||||||||

| TOTAL CURRENT LIABILITIES | ||||||||

| TOTAL LIABILITIES | ||||||||

| COMMITMENTS AND CONTINGENCIES | ||||||||

| STOCKHOLDERS’ DEFICIT | ||||||||

| Preferred stock Series A, $ par value, shares authorized, shares issued and outstanding as of June 30, 2025 and December 31, 2024, respectively | ||||||||

| Preferred stock Series C, $ par value, shares authorized, and shares issued and outstanding as of June 30, 2025 and December 31, 2024, respectively | ||||||||

| Common stock, $ par value, shares authorized, and shares issued and outstanding as of June 30, 2025 and December 31, 2024, respectively | ||||||||

| Additional paid in capital | ||||||||

| Accumulated deficit | ( |

) | ( |

) | ||||

| TOTAL STOCKHOLDERS’ DEFICIT | ( |

) | ( |

) | ||||

| TOTAL LIABILITIES AND STOCKHOLDERS’ DEFICIT | $ | $ | ||||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

1

PELTHOS THERAPEUTICS INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2025 AND 2024

(Unaudited)

| For the Three months Ended June 30, | For the Six months Ended June 30, | ||||||||||||||

| 2025 |

2024

|

2025 | 2024 | ||||||||||||

| OPERATING EXPENSES | |||||||||||||||

| General and administrative expenses | $ | $ | $ | $ | |||||||||||

| Research and development | |||||||||||||||

| Professional fees | |||||||||||||||

| Total operating expenses | |||||||||||||||

| NET LOSS FROM OPERATIONS | ( |

) | ( |

) | ( |

) | ( |

) | |||||||

| OTHER EXPENSE | |||||||||||||||

| Interest expense | ( |

) | ( |

) | ( |

) | ( |

) | |||||||

| Interest income | |||||||||||||||

| Total other expense | ( |

) | ( |

) | ( |

) | ( |

) | |||||||

| Net loss before provision for income taxes | ( |

) | ( |

) | ( |

) | ( |

) | |||||||

| Provision for income taxes | |||||||||||||||

| NET LOSS | $ | ( |

) | ( |

) | ( |

) | ( |

) | ||||||

| Net loss per common share - basic and diluted | $ | ) | ) | ) | ) | ||||||||||

| Weighted average number of common shares outstanding during the period - basic and diluted | |||||||||||||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

2

PELTHOS THERAPEUTICS INC.

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ DEFICIT

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2025 AND 2024

(Unaudited)

| Preferred

A Shares |

Preferred A Shares Par |

Preferred C Shares |

Preferred C Shares Par |

Common Shares |

Par | Additional Paid-in Capital |

Accumulated Deficit |

Total Stockholders’ Deficit |

||||||||||||||||||||||||||||

| Balance, December 31, 2023 | $ | $ | $ | $ | $ | ( |

) | $ | ( |

) | ||||||||||||||||||||||||||

| Stock-based compensation | — | — | — | |||||||||||||||||||||||||||||||||

| Issuance cost from common stock issued for extension of bridge loan | — | — | ||||||||||||||||||||||||||||||||||

| Conversion of preferred stock | ( |

) | ( |

) | — | |||||||||||||||||||||||||||||||

| Common stock issued for cash | — | — | ||||||||||||||||||||||||||||||||||

| Standby agreement | — | — | ||||||||||||||||||||||||||||||||||

| Recission of common stock | — | — | ( |

) | ( |

) | ( |

) | ( |

) | ||||||||||||||||||||||||||

| Transfer of liabilities to Chromocell Corp. for preferred C shares | — | — | ||||||||||||||||||||||||||||||||||

| Common stock issued for conversion of notes | — | — | ||||||||||||||||||||||||||||||||||

| Net loss | — | — | — | ( |

) | ( |

) | |||||||||||||||||||||||||||||

| Balance March 31, 2024 | $ | $ | $ | $ | $ | $ | ( |

) | $ | |||||||||||||||||||||||||||

| Stock option compensation | — | — | — | |

||||||||||||||||||||||||||||||||

| RSU expense | — | — | — | |||||||||||||||||||||||||||||||||

| Shares issued for services | — | — | ||||||||||||||||||||||||||||||||||

| Net loss | — | — | — | ( |

) | ( |

) | |||||||||||||||||||||||||||||

| Balance June 30, 2024 | $ | $ | $ | $ | $ | |

$ | ( |

) | $ | ( |

) | ||||||||||||||||||||||||

3

PELTHOS THERAPEUTICS INC.

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ DEFICIT

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2025 AND 2024

(Unaudited)

| Preferred

A Shares |

Preferred A Shares Par |

Preferred C Shares |

Preferred C Shares Par |

Common Shares |

Par | Additional Paid-in Capital |

Accumulated Deficit |

Total Stockholders’ Deficit |

||||||||||||||||||||||||||||

| Balance, December 31, 2024 | $ | $ | $ | $ | $ | ( |

) | $ | ( |

) | ||||||||||||||||||||||||||

| Stock-based compensation | — | — | — | |||||||||||||||||||||||||||||||||

| Restricted Stock Units expense | — | — | ||||||||||||||||||||||||||||||||||

| Shares issued for services | — | — | ||||||||||||||||||||||||||||||||||

| Shares issued for cash | — | — | ||||||||||||||||||||||||||||||||||

| Net loss | — | — | — | ( |

) | ( |

) | |||||||||||||||||||||||||||||

| Balance March 31, 2025 | $ | $ | $ | $ | $ | ( |

) | $ | ( |

) | ||||||||||||||||||||||||||

| Stock-based compensation | — | — | — | |||||||||||||||||||||||||||||||||

| Restricted Stock Units expense | — | — | ||||||||||||||||||||||||||||||||||

| Shares issued for services | — | — | ||||||||||||||||||||||||||||||||||

| Shares issued for conversion of notes | — | — | ||||||||||||||||||||||||||||||||||

| Stock split | — | — | ( |

) | ( |

) | ||||||||||||||||||||||||||||||

| Net loss | — | — | — | ( |

) | ( |

) | |||||||||||||||||||||||||||||

| Balance June 30, 2025 | $ | $ | $ | $ | $ | ( |

) | $ | ( |

) | ||||||||||||||||||||||||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

4

PELTHOS THERAPEUTICS INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

FOR THE SIX MONTHS ENDED JUNE 30, 2025 AND 2024

(Unaudited)

| For the six months Ended June 30, | ||||||||

| 2025 | 2024 | |||||||

| CASH FLOWS FROM OPERATING ACTIVITIES: | ||||||||

| Net loss | $ | ( |

) | $ | ( |

) | ||

| Adjustments to reconcile net loss to net cash used in operating activities | ||||||||

| Amortization of debt discount | ||||||||

| Stock-based compensation | ||||||||

| Changes in operating assets and liabilities: | ||||||||

| Accounts payable and accrued expenses | ( |

|||||||

| Accrued compensation | ( |

) | ||||||

| Due from Chromocell Corporation | ( |

) | ||||||

| Prepaid expenses | ( |

) | ||||||

| Net Cash Used In Operating Activities | ( |

) | ( |

) | ||||

| CASH FLOWS FROM FINANCING ACTIVITIES: | ||||||||

| Proceeds from loan payable, net of debt discount | ||||||||

| Proceeds from loan payable, net of debt discount - related party | ||||||||

| Payment of bridge loan, net of debt discount | ( |

) | ||||||

| Common stock issued for cash | ||||||||

| Recission of common stock | ( |

) | ||||||

| Net Cash Provided By Financing Activities | ||||||||

| NET CHANGE IN CASH | ( |

) | ||||||

| CASH AT BEGINNING OF YEAR | ||||||||

| CASH AT END OF YEAR | $ | $ | ||||||

| Supplemental cash flow information: | ||||||||

| Cash paid for income taxes | $ | $ | ||||||

| Cash paid for interest expense | $ | $ | ||||||

| NONCASH INVESTING AND FINANCING ACTIVITIES: | ||||||||

| Debt discount from common stock issued for extension of bridge loan | $ | $ | ||||||

| Conversion of notes to common stock | $ | $ | ||||||

| Transfer of liabilities to Chromocell Corporation for Series C Preferred Stock | $ | $ | ||||||

| Offering costs recorded to debt discount | $ | $ | ||||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

5

PELTHOS THERAPEUTICS INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

NOTE 1 – ORGANIZATION AND NATURE OF BUSINESS

Company Background

Chromocell Therapeutics Corporation (“Chromocell” or the “Predecessor”) was incorporated in Delaware on March 19, 2021. On November 18, 2024 (“Reincorporation Merger Effective Date”), Chromocell merged with and into its wholly-owned subsidiary, Channel Therapeutics Corporation, a Nevada corporation (the “Reincorporation Merger”), pursuant to an agreement and plan of merger, dated as of November 18, 2024 (the “Reincorporation Merger Agreement”) for the purposes of reincorporating Chromocell in Nevada. All information disclosed in this Form 10-Q for periods prior to the Reincorporation Merger Effective Date relates to the Predecessor, and all information disclosed in this Form 10-Q for periods after the Reincorporation Merger Effective Date relates Channel Therapeutics Corporation, a Nevada corporation (“Channel”).

On August 10, 2022, the Company entered into that certain Contribution Agreement with Chromocell Corporation, a Delaware corporation (“Chromocell Holdings”), pursuant to which, effective July 12, 2022, Chromocell Holdings contributed all assets and liabilities related to Chromocell Holdings’ historical therapeutic business, including all patents, pre-clinical and Phase I study results and data, and trade secrets related to the CC8464 compound to the Company (See Note 4). On October 22, 2024, the Company’s shareholders approved a reincorporation merger of the Company in the State of Nevada with and into Pelthos Therapeutics Inc., wholly-owned subsidiary of the Company, with Pelthos Therapeutics Inc. remaining as the surviving corporation immediately following the reincorporation merger (the “Reincorporation Merger”). The Reincorporation Merger occurred on November 18, 2024.

The Company is a clinical-stage biotech company focused on developing and commercializing new therapeutics to alleviate pain. The Company’s clinical focus is to selectively target the sodium ion-channel known as “NaV1.7”, which has been genetically validated as a pain receptor in human physiology. A NaV1.7 blocker is a chemical entity that modulates the structure of the sodium-channel in a way to prevent the transmission of pain perception to the central nervous system (“CNS”). The Company’s goal is to develop a novel and proprietary class of NaV blockers that target the body’s peripheral nervous system.

Overview

The Company has a limited operating history and has not generated revenue from its intended operations. The Company’s business and operations are sensitive to general business and economic conditions in the U.S. and worldwide along with local, state, and federal governmental policy decisions. A host of factors beyond the Company’s control could cause fluctuations in these conditions. Adverse conditions may include changes in the biotechnology regulatory environment, technological advances that render the Company’s technologies obsolete, availability of resources for clinical trials, acceptance of technologies into the medical community, and competition from larger, more well-funded companies.

Initial Public Offering

On

February 21, 2024,

6

Reincorporation Merger and Name Change

On October 22, 2024, the affirmative vote of a majority of the outstanding shares of Common Stock present in person, by remote communication, if applicable, or represented by proxy at the Annual Meeting approved the Reincorporation Merger. The Reincorporation Merger occurred on November 18, 2024.

Merger Transactions

On July 1, 2025 (the “Merger Closing Date”), Channel consummated the previously announced merger transaction contemplated by that certain Agreement and Plan of Merger, dated as of April 16, 2025 (the “Merger Agreement”), by and among Channel, CHRO Merger Sub, Inc., a Delaware corporation and a wholly owned subsidiary of the Company (“Merger Sub”), LNHC, Inc. a Delaware corporation and a wholly owned subsidiary of Ligand Pharmaceuticals Incorporated (“Ligand”), and solely for the purposes of Article III thereof, Ligand. Pursuant to the Merger Agreement, (i) Merger Sub merged with and into LNHC, with LNHC as the surviving company in the merger and, after giving effect to such merger, continuing as a wholly-owned subsidiary of the Company (the “Merger”), (ii) Channel’s name was changed from Channel Therapeutics Corporation to Pelthos Therapeutics Inc. (“Pelthos” or the “Company”) and (iii) the Company effected a 10-for-1 reverse stock split of all outstanding shares of its Common Stock (the “Reverse Stock Split”).

The Common Stock share amounts included in these Notes to the Company’s financials are presented on a post-split basis and reflect the Reverse Split.

NOTE 2 – LIQUIDITY AND GOING CONCERN

A fundamental principle of the preparation of financial statements in accordance with GAAP is the assumption that an entity will continue in existence as a going concern, which contemplates continuity of operations and the realization of assets and settlement of liabilities occurring in the ordinary course of business. In accordance with this requirement, the Company has prepared its accompanying consolidated financial statements assuming the Company will continue as a going concern.

During

the three and six months ended June 30, 2025, the Company had a net loss of approximately $

Based

on the Company’s current projections, management believes there is substantial doubt about its ability to continue to

operate as a going concern and fund its operations through at least the next twelve months following the issuance of these

condensed consolidated financial statements. While the Company completed an equity offering of $

The condensed consolidated financial statements included in this report do not include any adjustments to reflect the possible future effects on the recoverability and classification of assets or the amounts and classification of liabilities that may result from the matters discussed herein. While the Company believes in the viability of the Company’s strategy to generate sufficient revenue, control costs, and raise additional funds, when necessary, there can be no assurances to that effect. The Company’s ability to continue as a going concern is dependent upon the ability to implement the business plan, generate sufficient revenues, raise capital, and to control operating expenses.

7

NOTE 3 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) for interim financial information and the rules and regulations of the Securities and Exchange Commission (“SEC”). In the opinion of the Company’s management, the accompanying condensed consolidated financial statements reflect all adjustments, consisting of normal, recurring adjustments, considered necessary for a fair presentation of the results for the interim periods ended June 30, 2025 and 2024. Although management believes that the disclosures in these unaudited condensed consolidated financial statements are adequate to make the information presented not misleading, certain information and footnote disclosures normally included in condensed consolidated financial statements that have been prepared in accordance U.S. GAAP have been omitted pursuant to the rules and regulations of the SEC.

The accompanying unaudited condensed consolidated financial statements should be read in conjunction with the Company’s financial statements and notes related thereto included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2024, filed with the SEC on March 27, 2025. The interim results for the three and six months ended June 30, 2025 are not necessarily indicative of the results to be expected for the year ending December 31, 2025 or for any future interim periods.

Emerging Growth Company

The Company is an “emerging growth company,” as defined in Section 2(a) of the Securities Act of 1933, as amended (the “Securities Act”), as modified by the Jumpstart Our Business Startups Act of 2012, as amended (the “JOBS Act”), and it may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not emerging growth companies including, but not limited to, not being required to comply with the independent registered public accounting firm attestation requirements of Section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in its periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved.

Further, Section 102(b)(1) of the JOBS Act exempts emerging growth companies from being required to comply with new or revised financial accounting standards until private companies (that is, those that have not had a Securities Act registration statement declared effective or do not have a class of securities registered under the Exchange Act) are required to comply with the new or revised financial accounting standards. The JOBS Act provides that a company can elect to opt out of the extended transition period and comply with the requirements that apply to non-emerging growth companies but any such election to opt out is irrevocable. The Company has elected not to opt out of such extended transition period which means that when a standard is issued or revised and it has different application dates for public or private companies, the Company, as an emerging growth company, can adopt the new or revised standard at the time private companies adopt the new or revised standard. This may make comparison of the Company’s consolidated financial statements with another public company which is neither an emerging growth company nor an emerging growth company which has opted out of using the extended transition period difficult or impossible because of the potential differences in accounting standards used.

Principles of consolidation

The consolidated financial statements include the accounts of Pelthos Therapeutics Inc. and its wholly owned subsidiaries, Chromocell Therapeutics Australia Pty. Ltd and CHRO Merger Sub Inc. All significant intercompany balances and transactions have been eliminated.

Use of Estimates

The preparation of consolidated financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the consolidated financial statements and the reported amounts of expenses during the reporting period. Actual results could differ from those estimates. Significant estimates made by management include, but are not limited to, estimating the valuation of deferred income taxes.

8

Cash and Cash Equivalents

The Company considers all highly liquid investments with an original maturity of three months or less when purchased to be cash equivalents. As of June 30, 2025 and December 31, 2024, the Company did not have any cash equivalents.

As of June 30, 2025, the Company did not have deposits in excess of federally insured limits.

Research and Development

The Company incurs research and development (“R&D”) costs during the process of researching and developing technologies and future offerings. The Company expenses these costs as incurred unless such costs qualify for capitalization under applicable guidance. The Company reviews acquired R&D and licenses to determine if they should be capitalized or expensed under U.S. GAAP standards.

Below is a disaggregation of R&D expenses:

| For

the three months Ended |

For

the three |

For

the six

|

For

the six months Ended |

||||||||||

| June 30, 2025 | June 30, 2024 | June 30, 2025 | June 30, 2024 | ||||||||||

| Consultant | $ | $ | $ | $ | |||||||||

| Lab Materials | |||||||||||||

| Lab Cell Storage | |

||||||||||||

| Chemistry Manufacturing and Controls (“CMC”) | ( |

) | |||||||||||

| IP Services | |||||||||||||

| Total | $ | $ | $ | $ | |||||||||

Fair Value Measurements and Fair Value of Financial Instruments

The Company determines fair value based on assumptions that market participants would use in pricing an asset or liability in the principal or most advantageous market. When considering market participant assumptions in fair value measurements, the following fair value hierarchy distinguishes between observable and unobservable inputs, which are categorized in one of the following levels:

| ● | Level 1 Inputs are unadjusted quoted prices in active markets for identical assets or liabilities available at the measurement date. |

| ● | Level 2 Inputs are unadjusted quoted prices for similar assets and liabilities in active markets, quoted prices for identical or similar assets and liabilities in markets that are not active, inputs other than quoted prices that are observable, and inputs derived from or corroborated by observable market data. |

| ● | Level 3 Inputs are unobservable inputs which reflect the reporting entity’s own assumptions on what assumptions the market participants would use in pricing the asset or liability based on the best available information. |

The Company did not identify any assets or liabilities that are required to be presented on the balance sheets at fair value in accordance with ASC Topic 820.

Due to the short-term nature of all financial assets and liabilities, their carrying value approximates their fair value as of the balance sheet dates.

9

Stock-Based Compensation

The Company accounts for stock-based compensation costs under the provisions of ASC 718, Compensation—Stock Compensation (“ASC 718”), which requires the measurement and recognition of compensation expense related to the fair value of stock-based compensation awards that are ultimately expected to vest. Stock-based compensation expense recognized includes the compensation cost for all stock-based payments granted to employees, officers, and directors based on the grant date fair value estimated in accordance with the provisions of ASC 718. ASC 718 is also applied to awards modified, repurchased, or cancelled during the periods reported. Stock-based compensation is recognized as expense over the employee’s requisite vesting period and over the nonemployee’s period of providing goods or services. Pursuant to ASC 718, the Company can elect to either recognize the expenses on a straight-line or graded basis and has elected to do so under the straight-line basis.

Basic loss per common share is computed by dividing the net loss by the weighted average number of shares of Common Stock outstanding for each period. Diluted loss per share is computed by dividing the net loss by the weighted average number of shares of Common Stock outstanding plus the dilutive effect of shares issuable through the common stock equivalents. The weighted-average number of common shares outstanding excludes common stock equivalents because their inclusion would be anti-dilutive. As of June 30, 2025, stock options, warrants, and unvested restricted stock units (“RSUs”) were excluded from dilutive earnings per share as their effects were anti-dilutive. As of June 30, 2024, stock options, warrants, and unvested restricted stock units were excluded from dilutive earnings per share as their effects were anti-dilutive.

Income Taxes

The Company accounts for income taxes pursuant to the provision of ASC 740 “Accounting for Income Taxes,” (“ASC 740”) which requires, among other things, an asset and liability approach to calculating deferred income taxes. The asset and liability approach requires the recognition of deferred tax assets and liabilities for the expected future tax consequences of temporary differences between the carrying amounts and the tax bases of assets and liabilities. A valuation allowance is provided to offset any net deferred tax assets for which management believes it is more likely than not that the net deferred asset will not be realized.

The Company follows the provision of the ASC 740 related to Accounting for Uncertain Income Tax Position. When tax returns are filed, it is more likely than not that some positions taken would be sustained upon examination by the taxing authorities, while others are subject to uncertainty about the merits of the position taken or the amount of the position that would be ultimately sustained. In accordance with the guidance of ASC 740-10, the benefit of a tax position is recognized in the consolidated financial statements in the period during which, based on all available evidence, management believes it is most likely that not that the position will be sustained upon examination, including the resolution of appeals or litigation processes, if any. Tax positions taken are not offset or aggregated with other positions.

Tax positions that meet the more-likely-than-not recognition threshold are measured as the largest amount of tax benefit that is more than 50% likely of being realized upon settlement with the applicable taxing authority. The portion of the benefits associated with tax positions taken that exceeds the amount measured as described above should be reflected as a liability for uncertain tax benefits in the accompanying balance sheet along with any associated interest and penalties that would be payable to the taxing authorities upon examination. The Company believes its tax positions will more likely than not be upheld upon examination. As such, the Company has not recorded a liability for uncertain tax benefits.

The federal and state income tax returns of the Company are subject to examination by the Internal Revenue Service and state taxing authorities, generally for three years after they were filed. The Company has filed its tax returns for the year ended December 31, 2024 and after review of the prior year consolidated financial statements and the results of operations through December 31, 2024, the Company has recorded a full valuation allowance on its deferred tax asset.

10

Recently Issued Accounting Pronouncements

In December 2023, the FASB issued ASU 2023-09, Income Taxes (Topic 740): Improvements to Income Tax Disclosures, which requires disaggregated information about a reporting entity’s effective tax rate reconciliation, as well as information related to income taxes paid to enhance the transparency and decision usefulness of income tax disclosures. This ASU will be effective for the annual periods beginning after December 15, 2024. The Company is currently evaluating the impact ASU No. 2023-09 will have on its condensed consolidated financial statements.

In November 2024, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) No. 2024-03, "Disaggregation of Income Statement Expenses," which requires disclosures of certain disaggregated income statement expense captions into specified categories within the footnotes to the financial statements. The requirements of the ASU are effective for annual periods beginning after December 15, 2026 and interim reporting periods beginning after December 15, 2027, with early adoption permitted. The requirements will be applied prospectively with the option for retrospective application. The Company is currently evaluating the impact ASU No. 2024-03 will have on its condensed consolidated financial statements.

Other new accounting pronouncements issued, but not effective until after June 30, 2025, did not and are not expected to have a material impact on our financial position, results of operations or liquidity.

NOTE 4 – RELATED PARTY TRANSACTIONS

Due from/to Chromocell Holdings

As

of June 30, 2025 and December 31, 2024, the Company had a $

Related Party Note

On

May 10, 2024,

Outstanding Principal on Related Party Notes

| Note Payable – Related Party |

Outstanding

Principal

|

Unamortized

Debt Discount |

Outstanding

Principal, net of Debt Discount |

|||||||||

| Related Party Note | $ | $ | $ | |||||||||

| Total As of June 30, 2025 | $ | $ | $ | |||||||||

| Note Payable – Related Party |

Outstanding

Principal

|

Unamortized

Debt Discount |

Outstanding

Principal, net of Debt Discount |

|||||||||

| Related Party Note | $ | $ | $ | |||||||||

| Total As of December 31, 2024 | $ | $ | $ | |||||||||

11

NOTE 5 – NOTES PAYABLE

May Promissory Note

On

May 10, 2024, the Company converted accounts payable with a professional advisor into a promissory note in the amount of $

Convertible Note

On

July 24, 2024, the Company entered into a securities purchase agreement with an accredited investor (the “July Note Holder”),

pursuant to which the Company issued to the July Note Holder a senior unsecured convertible note (the “July Note”)

in the aggregate principal amount of $

As

of June 30, 2025, there was $

12

July Note Conversions

On

July 24, 2024, the Company entered into a securities purchase agreement with the July Note Holder, pursuant to which the Company

issued to the July Note Holder the July Note in the aggregate principal amount of $

Waiver of Exchange Cap

On October 22, 2024, the affirmative vote of a majority of the outstanding shares of Common Stock present in person, by remote communication, if applicable, or represented by proxy at the Annual Meeting approved the waiver of the Exchange Cap in connection with the July Note and the CEF Purchase Agreement.

February Bridge Note

On

February 25, 2025, the Company issued an unsecured promissory note in the aggregate principal amount of $

As

of June 30, 2025, there was $

February Bridge Note Amendment

On May 12, 2025, the Company executed a first amendment (the “February Bridge Note Amendment”) to the February Bridge Note. The February Bridge Note Amendment extends the maturity date of the February Bridge Note from May 25, 2025 to September 30, 2025. Aside from extending the maturity date of the February Bridge Note, the February Bridge Note Amendment does not amend, alter, restate or otherwise change the principal terms and conditions of the February Bridge Note.

May Bridge Note

On

May 8, 2025, the Company issued an unsecured promissory note in the aggregate principal amount of $

13

As

of June 30, 2025, there was $

June Bridge Note

On

June 23, 2025, the Company issued an unsecured promissory note in the aggregate principal amount of $

As

of June 30, 2025, there was $

Outstanding Principal on Notes

| Loan Payable |

Outstanding

Principal |

Unamortized

Debt Discount

|

Outstanding

Principal, net of

Debt Discount |

|||||||||

| May Promissory Note | $ | $ | $ | |||||||||

| February Bridge Note | ( |

) | ||||||||||

| May Bridge Note | ( |

) | ||||||||||

| June Bridge Note | ( |

) | ||||||||||

| Total As of June 30, 2025 | $ | $ | ( |

) | $ | |||||||

| Loan Payable |

Outstanding

Principal

|

Unamortized

Debt Discount

|

Outstanding

Principal, net of Debt Discount |

|||||||||

| May Promissory Note | $ | $ | $ | |||||||||

| Convertible Note | ( |

) | ||||||||||

| Total As of December 31, 2024 | $ | $ | ( |

) | $ | |||||||

14

NOTE 6 – STOCKHOLDERS’ EQUITY

Initial Public Offering

On

February 21, 2024, the Company completed its IPO and issued shares of Common Stock at a price of $ per

share. The aggregate net proceeds from the IPO were approximately $

Stock Split

On

February 15, 2024,

On

July 1, 2025,

2023 Plan Amendment

On

June 12, 2024, the Board authorized an amendment to the Pelthos Therapeutics Inc. 2023 Equity Incentive Plan (the “2023

Plan”) to increase the number of shares of Common Stock authorized for issuance thereunder by 150,000 from 44,444 shares

to

Stock Recission Agreement

On

February 10, 2024, the Company entered into a Stock Rescission Agreement with certain affiliates of A.G.P. (the “Stock Recission

Agreement”) pursuant to which the Company rescinded shares of Common Stock held by such affiliates of A.G.P.

and agreed to refund an aggregate of $

Equity Issuances

On June 12, 2024, the Company entered into a twelve-month agreement with a vendor to issue up to shares of Common Stock per month for services performed by such vendor. As of June 30, 2025 and December 31, 2024, the Company has issued and shares of Common Stock pursuant to this agreement, of which and shares were issued during the three and six months ended June 30, 2025. As of June 30, 2024, the Company has issued shares of Common Stock pursuant to this agreement, of which shares were issued during the three and six months ended June 30, 2024.

Committed Equity Financing

On

July 26, 2024, the Company entered into a Common Stock Purchase Agreement, dated as of July 26, 2024 (the “CEF Purchase

Agreement”), with Tikkun Capital LLC (“Tikkun”), providing for a committed equity financing facility, pursuant

to which, upon the terms and subject to the satisfaction of the conditions contained in the CEF Purchase Agreement, Tikkun has

committed to purchase, at the Company’s direction in its sole discretion, up to an aggregate of $ (the “Total

Commitment”) of the shares of Common Stock (the “Purchase Shares”), subject to certain limitations set forth

in the CEF Purchase Agreement, from time to time during the term of the CEF Purchase Agreement. Concurrently with the execution

of the CEF Purchase Agreement, the Company and Tikkun also entered into a Registration Rights Agreement, dated as of July 26,

2024, pursuant to which the Company agreed to file with the SEC one or more registration statements, to register under the Securities

Act, the offer and resale by Tikkun of all of the Purchase Shares that may be issued and sold by the Company to Tikkun from time

to time under the CEF Purchase Agreement. On October 2, 2024, the Company tendered shares to Tikkun for $

15

Stock Repurchase Plan

On

August 5, 2024, the Board authorized a stock repurchase plan (the “Repurchase Plan”) pursuant to which up to $

Repurchase Plan Amendment

On

October 22, 2024, the Board authorized an amendment (the “Amendment”) to the Repurchase Plan to increase the total

value of shares of Common Stock available for repurchase by the Company under the Repurchase Plan by an additional $

Chromocell Holdings Share Transfers

On December 18, 2024, 74,719 shares of Common Stock and shares of Series C Preferred Stock held by Chromocell Holdings were transferred by the Company to Alexandra Wood (Canada) Inc. (“AWI”) in satisfaction of a default judgement against Chromocell Holdings regarding the default by Chromocell Holdings of a secured promissory note by order of the Supreme Court of the State of New York, County of New York on November 25, 2024 in the matter Alexandra Wood (Canada) Inc v. Chromocell Corp., Index No. 651735/2024. AWI subsequently transferred 17,300 shares of Chromocell Holding’s Common Stock that it received such that AWI now owns 57,419 shares of the Common Stock originally issued to Chromocell Holdings in connection with the Contribution Agreement.

Securities Purchase Agreement

Concurrently

with the execution of the Merger Agreement, the Company entered into a securities purchase agreement (the “Securities Purchase

Agreement”) with LNHC and certain investors, which includes Ligand (collectively, the “PIPE Investors”), pursuant

to which, among other things, on the Closing Date and immediately prior to the consummation of the Merger, the PIPE Investors

purchased (either for cash or in exchange for the conversion of principal and interest payable under an outstanding convertible

note issued by the Company), and the Company issued and sold to the PIPE Investors, an aggregate of shares of the Company’s

Series A Convertible Preferred Stock, par value $ per share (the “Series A Preferred Stock”) at a price per

share equal to $ (such transaction, the “PIPE Financing”). The gross proceeds from the PIPE Financing were approximately

$

On July 1, 2025, the Company, LNHC and the PIPE Investors entered into Amendment No. 1 to Securities Purchase Agreement, pursuant to which, the Company, LNHC and the PIPE Investors consented to the inclusion of two additional PIPE Investors in the PIPE Financing and a corresponding decrease in the amount of certain PIPE Investors’ investments in the PIPE Financing such that the aggregate amount of the PIPE Financing would remain unchanged (the “Securities Purchase Agreement Amendment”).

16

In general, a holder of shares of Series A Preferred Stock may not convert any portion of Series A Preferred Stock if the holder, together with its affiliates, would beneficially own more than 49.9% in the case of Ligand or 4.99%, in the case of the other PIPE Investors (the “Maximum Percentage”), of the number of shares of the Company’s Common Stock outstanding immediately after giving effect to such exercise, provided, however, that a holder may increase or decrease the Maximum Percentage by giving 61 days’ notice to the Company, but not to any percentage in excess of 9.99%.

The shares of Series A Preferred Stock to be issued and sold to the PIPE Investors were not registered under the Securities Act and were issued and sold in reliance on the exemption from registration requirements thereof provided by Section 4(a)(2) of the Securities Act as a transaction by an issuer not involving a public offering.

The closing of the PIPE Financing occurred on July 1, 2025, immediately prior to the consummation of the Merger

On July 1, 2025, certain PIPE Investors entered into Series A Convertible Preferred Stockholder Side Letters (each, a “Side Letter”) with the Company, pursuant to which, immediately after the closing of the PIPE Financing on July 1, 2025, the PIPE Investors converted 23,810 shares of Series A Preferred Stock not exceeding such PIPE Investors’ Maximum Percentage into an aggregate of 2,381,000 shares of the Company’s Common Stock (after giving effect to the Reverse Stock Split), by providing the Company with a completed and signed Conversion Notice under the Certificate of Designation.

Options

During the three months ended June 30, 2025 and 2024, the Company granted and stock options related to the Company’s common stock, respectively.

During the six months ended June 30, 2025 and 2024, the Company granted and stock options related to the Company’s common stock, respectively.

With

certain adjustments outlined below, the Company based its determination of the underlying fair value of the Company’s Common

Stock on the findings of an independent third party engaged by the Company to determine the fair value of the Company’s

intellectual property. The Company had the analysis conducted in conjunction with the Contribution Agreement, which was executed

on August 10, 2022. The analysis determined that the fair value of the Company’s intellectual property was $

| Value of intellectual property | $ | |||

| Common shares outstanding (as converted) | ||||

| Value per common share | $ | |||

| Illiquidity discount | % | |||

| Minority discount | % | |||

| Fair value of the common stock | $ |

17

After the completion of the Company’s IPO, the trading price of the Company’s Common Stock is used as the fair value of the Company’s Common Stock.

The Company determined the expected volatility assumption for options granted using the historical volatility of comparable public companies’ common stock. The Company will continue to monitor peer companies and other relevant factors used to measure expected volatility for future option grants, until such time that the Company’s Common Stock has enough market history to use historical volatility.

The dividend yield assumption for options granted is based on the Company’s history and expectation of dividend payouts. The Company has never declared nor paid any cash dividends on its Common Stock, and the Company does not anticipate paying any cash dividends in the foreseeable future.

The Company recognizes option forfeitures as they occur as there is insufficient historical data to accurately determine future forfeiture rates.

| Weighted Average |

Weighted Average |

|||||||||||

| Number

of Shares |

Exercise

Price

|

Remaining Life |

||||||||||

| Stock Options | ||||||||||||

| Outstanding December 31, 2024 | $ | |||||||||||

| Granted | — | |||||||||||

| Expired | — | |||||||||||

| Exercised | — | |||||||||||

| Outstanding June 30, 2025 | $ | |||||||||||

| Exercisable June 30, 2025 | $ | |||||||||||

| Weighted Average |

Weighted Average |

|||||||||||

| Number

of Shares |

Exercise

Price

|

Remaining Life |

||||||||||

| Stock Options | ||||||||||||

| Outstanding December 31, 2023 | $ | |||||||||||

| Granted | $ | |||||||||||

| Expired | ( |

) | $ | ( |

) | — | ||||||

| Exercised | $ | — | ||||||||||

| Outstanding June 30, 2024 | $ | |||||||||||

| Exercisable June 30, 2024 | $ | |||||||||||

| Non-vested Options | Options | Weighted- Average Exercise Price |

||||||

| Non-vested at December 31, 2024 | $ | |||||||

| Granted | ||||||||

| Vested | ( |

) | ||||||

| Forfeited | ||||||||

| Non-vested at June 30, 2025 | $ | |||||||

18

| Non-vested Options | Options | Weighted- Average Exercise Price |

||||||

| Non-vested at December 31, 2023 | $ | |||||||

| Granted | $ | |||||||

| Vested | ( |

) | $ | |||||

| Forfeited | $ | |||||||

| Non-vested at June 30, 2024 | $ | |||||||

The

Company recognized stock-based compensation expense related to option vesting amortization of $

As

of June 30, 2025, the unamortized stock option expense was $

Warrants

| Weighted Average |

Weighted Average |

|||||||||||

| Number

of Shares |

Exercise

Price

|

Remaining Life |

||||||||||

| Stock Warrants | ||||||||||||

| Outstanding December 31, 2024 | $ | |||||||||||

| Granted | — | |||||||||||

| Expired | — | |||||||||||

| Exercised | — | |||||||||||

| Outstanding June 30, 2025 | $ | |||||||||||

| Exercisable June 30, 2025 | $ | |||||||||||

| Weighted Average |

Weighted Average |

|||||||||||

| Number |

Exercise

Price

|

Remaining Life |

||||||||||

| Stock Warrants | ||||||||||||

| Outstanding December 31, 2023 | $ | — | ||||||||||

| Granted | ||||||||||||

| Expired | — | |||||||||||

| Exercised | — | |||||||||||

| Outstanding June 30, 2024 | $ | |||||||||||

| Exercisable June 30, 2024 | $ | |||||||||||

19

A summary of the status of the Company’s nonvested warrants as of June 30, 2025 and 2024, and changes during the three and six months ended June 30, 2025 and 2024, is presented below:

| Non-vested Warrants | Warrants | Weighted- Average Exercise Price |

||||||

| Non-vested at December 31, 2024 | $ | |||||||

| Granted | ||||||||

| Vested | ||||||||

| Forfeited | ||||||||

| Non-vested at June 30, 2025 | $ | |||||||

| Non-vested Warrants | Warrants | Weighted- Average Exercise Price |

||||||

| Non-vested at December 31, 2023 | $ | |||||||

| Granted | ||||||||

| Vested | ( |

) | ||||||

| Forfeited | ||||||||

| Non-vested at June 30, 2024 | $ | |||||||

The

total number of warrants granted during the three months ended June 30, 2025 and 2024 was and ,respectively. The total number of warrants granted during the six months ended June 30, 2025 and 2024 was and ,

respectively. The exercise price for these warrants was $ per share and there was an intrinsic value of $

The

Company recognized stock-based compensation expense related to warrant vesting amortization of $

RSUs

A summary of the status of the Company’s nonvested RSUs as of June 30, 2024, and changes during the three and six months ended June 30, 2024, is presented below:

| Non-vested RSUs | RSUs | Weighted- Average Exercise Price |

||||||

| Non-vested at December 31, 2023 | $ | |||||||

| Granted | $ | |||||||

| Vested | $ | |||||||

| Forfeited | $ | |||||||

| Non-vested at June 30, 2024 | $ | |||||||

A summary of the status of the Company’s nonvested RSUs as of June 30, 2025, and changes during the three and six months ended June 30, 2025, is presented below:

| Non-vested RSUs | RSUs | Weighted- Average Exercise Price |

|||||||

| Non-vested at December 31, 2024 | $ | ||||||||

| Granted | |||||||||

| Vested | ( |

) | ( |

) | |||||

| Forfeited | |||||||||

| Non-vested at June 30, 2025 | $ | ||||||||

20

The total number of RSUs granted during the three months ended June 30, 2025 and 2024 was and respectively. The total number of RSUs granted during the six months ended June 30, 2025 and 2024 was and respectively.

The

Company recognized stock-based compensation expense related to RSU vesting amortization of $

NOTE 7 – SEGMENT DISCLOSURE

The clinical-stage biotech segment focused on developing and commercializing new therapeutics to alleviate pain. Our clinical focus is to selectively target the sodium ion-channel known as “NaV1.7”, which has been genetically validated as a pain receptor in human physiology. A NaV1.7 blocker is a chemical entity that modulates the structure of the sodium-channel in a way to prevent the transmission of pain perception to the CNS. Our goal is to develop a novel and proprietary class of NaV blockers that target the body’s peripheral nervous system. This segment is currently pre-revenue.

The accounting policies of the clinical-stage biotech segment are the same as those described in the summary of significant accounting policies.

The chief operating decision maker assesses performance for the clinical-stage biotech segment and decides how to allocate resources based on net loss that also is reported on the statement of operations as consolidated net loss.

The measure of segment assets is reported on the balance sheet as total assets.

The chief operating decision maker uses net loss to evaluate spending in deciding how funds should be allocated in preforming the Company’s research and development. Net loss is used to monitor budget versus actual results.

The Company has one reportable segment: clinical-stage biotech. This segment performs research and development for biotech products. Since the Company only has one segment, the segment information is the same as the consolidated financials.

The Company’s chief operating decision maker is the chief executive officer, with such individual also holding the position of chief financial officer.

NOTE 8 – SUBSEQUENT EVENTS

The Merger

On July 1, 2025 (the “Closing Date”), Pelthos consummated the previously announced merger transaction contemplated by that certain Merger Agreement, by and among the Company, Merger Sub, LNHC, and solely for the purposes of Article III thereof, Ligand. Pursuant to the Merger Agreement, (i) Merger Sub merged with and into LNHC, with LNHC as the surviving company in the Merger and, after giving effect to such Merger, continuing as a wholly-owned subsidiary of the Company and (ii) the Company’s name was changed from Channel Therapeutics Corporation to Pelthos Therapeutics Inc.

Following the completion of the Merger, the business conducted by the Company became primarily the business conducted by LNHC, which is a is a biopharmaceutical company committed to commercializing innovative, safe, and efficacious therapeutic products to help patients with unmet treatment burdens.

21

At the effective time of the Merger (the “Effective Time”), the Company issued an aggregate of approximately shares of Series A Preferred Stock to Ligand, based on the exchange ratio set forth in the Merger Agreement, resulting in approximately shares of the Company’s Series A Preferred Stock being issued and outstanding immediately following the Effective Time. Immediately following the Merger, the Company’s securityholders as of immediately prior to the Merger owned approximately 7.9% of the outstanding shares of the Company and LNHC securityholders owned approximately 55.8% of the outstanding shares of the Company, in each case on a fully diluted basis, calculated using the treasury stock method.

The shares of Series A Preferred Stock issued to Ligand in the Merger will not be registered under the Securities Act and will be issued and sold in reliance on the exemption from registration requirements thereof provided by Section 4(a)(2) of the Securities Act as a transaction by an issuer not involving a public offering.

The shares of the Company’s Common Stock listed on the NYSE American LLC, previously trading through the close of business on July 1, 2025 under the ticker symbol “CHRO,” commenced trading on the NYSE American under the ticker symbol “PTHS,” on July 2, 2025. The Company’s Common Stock is represented by a new CUSIP number, 171126 204.

PIPE Financing (Private Placement) and Conversions of Series A Preferred Stock

Concurrently

with the execution of the Merger Agreement, the Company entered into the Securities Purchase Agreement with certain PIPE Investors,

pursuant to which, among other things, on the Closing Date and immediately prior to the consummation of the Merger, the PIPE Investors

purchased (either for cash or in exchange for the conversion of principal and interest payable under an outstanding convertible

note issued by the Company), and the Company issued and sold to the PIPE Investors, an aggregate of shares of the Company’s

Series A Preferred Stock, in the PIPE Financing. The gross proceeds from the PIPE Financing were approximately $

On July 1, 2025, the Company, LNHC and the PIPE Investors entered into the Securities Purchase Agreement Amendment, pursuant to which, the Company, LNHC and the PIPE Investors consented to the inclusion of two additional PIPE Investors in the PIPE Financing and a corresponding decrease in the amount of certain PIPE Investors’ investments in the PIPE Financing such that the aggregate amount of the PIPE Financing would remain unchanged.

In general, a holder of shares of Series A Preferred Stock may not convert any portion of Series A Preferred Stock if the holder, together with its affiliates, would beneficially own the Maximum Percentage, of the number of shares of the Company’s Common Stock outstanding immediately after giving effect to such exercise, provided, however, that a holder may increase or decrease the Maximum Percentage by giving 61 days’ notice to the Company, but not to any percentage in excess of 9.99%.

The shares of Series A Preferred Stock to be issued and sold to the PIPE Investors were not registered under the Securities Act and were issued and sold in reliance on the exemption from registration requirements thereof provided by Section 4(a)(2) of the Securities Act as a transaction by an issuer not involving a public offering.

The closing of the PIPE Financing occurred on July 1, 2025, immediately prior to the consummation of the Merger.

22

On July 1, 2025, certain PIPE Investors entered into Series A Convertible Preferred Stockholder Side Letters with the Company, pursuant to which, immediately after the closing of the PIPE Financing on July 1, 2025, the PIPE Investors converted 23,810 shares of Series A Preferred Stock not exceeding such PIPE Investors’ Maximum Percentage into an aggregate of 2,381,000 shares of the Company’s Common Stock (after giving effect to the Reverse Stock Split), by providing the Company with a completed and signed Conversion Notice under the Certificate of Designation.

Registration Rights Agreement

On the Closing Date and in connection with the Merger, the Company and the PIPE Investors entered into a registration rights agreement (the “Registration Rights Agreement”) pursuant to which the PIPE Investors are entitled to certain resale registration rights with respect to shares of the Company’s Common Stock issuable upon conversion of the Series A Preferred Stock issued to the PIPE Investors. Pursuant to the Registration Rights Agreement, the Company is required to prepare and file a resale registration statement with the SEC on or prior to the later of (i) 30 calendar days following the closing of the PIPE Financing and (ii) fifteen (15) calendar days after the Company’s next periodic report required pursuant to Section 13 of the Exchange Act. The Company is obligated to use reasonable best efforts to cause this registration statement to be declared effective by the SEC within 120 calendar days following the closing of the PIPE Financing (or within 150 calendar days following the closing of the PIPE Financing if the SEC reviews the registration statement).

The Company will, among other things, indemnify the PIPE Investors, their directors, officers, shareholders, members, partners, employees, agents, advisors and representatives of the foregoing and each person who controls the PIPE Investors (a) under the registration statement, including from certain liabilities and fees and expenses (excluding underwriting discounts and selling commissions and all legal fees and expenses of legal counsel for any selling holder) and (b) under the Securities Purchase Agreement, including with respect to breaches of the Company’s representations, warranties, and covenants under the Securities Purchase Agreement.

Contribution Agreement and IP Assignment and Assumption Agreement

On July 1, 2025 (the “Contribution Date”), the Company entered into a Contribution Agreement (the “Contribution Agreement”) with Channel Pharmaceutical Corporation, a Nevada corporation (“Pharmaceutical Sub”) - a newly formed, wholly-owned subsidiary of the Company. Pursuant to the terms of the Contribution Agreement, the Company contributed to Pharmaceutical Sub certain assets associated with non-opioid, non-addictive therapeutics to alleviate pain, and owns certain patents and “Know How” (as defined in the Contribution Agreement) and other technology relating to the sodium ion-channel known as NaV1.7 for the treatment of various types of systemic chronic pain, acute and chronic eye pain and post-surgical nerve blocks (collectively, the “Intellectual Property Rights”) and certain other assets related thereto (collectively, the “Transferred Assets”).

Pharmaceutical Sub accepted the Transferred Assets as of the Contribution Date. In exchange for the Transferred Assets, Pharmaceutical Sub issued to the Company 100 shares of Pharmaceutical Sub’s common stock. After the above contribution, Pharmaceutical Sub may engage in licensing, developing and commercializing the Intellectual Property Rights.

In connection with the Contribution Agreement, on July 1, 2025, the Company, as assignor, entered into an Intellectual Property Assignment and Assumption Agreement (the “IP Assignment and Assumption Agreement”) with Pharmaceutical Sub, as assignee, pursuant to which the Company irrevocably conveyed, transferred and assigned of the Company’s interests in, to and under the Intellectual Property Rights, including without limitation, the specific intellectual property rights and Know How set forth in the Contribution Agreement, together with any and all goodwill associated with such intellectual property rights (collectively, the “Assigned IP”). Pharmaceutical Sub accepted the conveyance, transfer and assignment of the Assigned IP as of the Contribution Date.

Royalty Agreements

As an inducement to enter into the Securities Purchase Agreement, the Company and LNHC, as Seller Parties, and Nomis RoyaltyVest LLC (“NRV”) entered into a Purchase and Sale Agreement, dated as of July 1, 2025 (the “ZELSUVMI Royalty Agreement”), pursuant to which the Company and LNHC sold to NRV, and NRV purchased, all of the Company’s and LNHC’s rights, title and interest in and to a portion of the Company’s and LNHC’s revenue payments for ZELSUVMI and all accounts with respect thereto. In addition, prior to the expiration of the Initial Royalty Term (as defined in the ZELSUVMI Royalty Agreement), NRV will receive a 1.5% royalty on net sales of ZELSUVMI worldwide, other than in Japan, and 3.46% of non-royalty sublicensing payments received by LNHC for its sublicensing of rights to ZELSUVMI, and (ii) after the expiration of the Initial Royalty Term, NRV will receive a 1.2% royalty on net sales of ZELSUVMI worldwide, other than in Japan, and 3.46% of non-royalty sublicensing payments received by LNHC for its sublicensing of rights to ZELSUVMI.

23

On July 1, 2025, the Company and Pharmaceutical Sub, as Seller Parties and NRV, Ligand, and Madison Royalty LLC, a Colorado limited liability company, on behalf of certain of the Company’s management team and other assignees (“Madison”) entered into a Purchase and Sale Agreement (the “Channel Products Royalty Agreement”), pursuant to which the Company and Pharmaceutical Sub sold to each of NRV, Ligand, and Madison, and each of NRV, Ligand, and Madison purchased, all of the Company’s and Pharmaceutical Sub’s rights, title and interest in and to a portion of the Company’s and Pharmaceutical Sub’s revenue payments and all accounts related to or utilizing (i) Nitricil based technology, (ii) Xepi, or (iii) NaV channel based technology and, in each case, any improvements, successors, replacements or varying dosage forms of the foregoing, other than ZELSUVMI (the “Channel Covered Products”). In addition, (A) prior to the expiration of the Initial Royalty Term (as defined in the Channel Products Royalty Agreement), (i) NRV will receive a 5.3% royalty, Ligand will receive a 1.7% royalty and Madison will receive a 1.5% royalty on Net Sales (as defined in the Channel Products Royalty Agreement) of the Channel Covered Products worldwide, and (ii) NRV will receive 12.23%, Ligand will receive 3.92% and Madison will receive 3.46% of non-royalty sublicensing payments received by Pharmaceutical Sub for its sublicensing of rights to the Channel Covered Products worldwide; and (B) after the expiration of the Initial Royalty Term, (i) NRV will receive a 4.24% royalty, Ligand will receive a 1.36% royalty and Madison will receive a 1.2% royalty on Net Sales of the Channel Covered Products worldwide, and (ii) NRV will receive 12.23%, Ligand will receive 3.92% and Madison will receive 3.46% of non-royalty sublicensing payments received by Pharmaceutical Sub for its sublicensing of rights to the Channel Covered Products worldwide.

Name Change

In connection with the consummation of the Merger, the Company changed its name from “Channel Therapeutics Corporation” to “Pelthos Therapeutics, Inc.” pursuant to the Name Change Certificate of Amendment.

After consummation of the Merger and the Reverse Stock Split, shares of the Company’s Common Stock were listed on the NYSE American under the symbol “PTHS,” and the CUSIP number relating to the Common Stock was changed to 171126 204. Holders of shares of Channel Therapeutics Corporation who have filed reports under the Exchange Act with respect to those shares should indicate in their next filing, or any amendment to a prior filing, filed on or after the Closing Date that the Company is the successor to Channel Therapeutics Corporation.

Reverse Stock Split

Immediately after the consummation of the Merger, the Company effected the Reverse Stock Split pursuant to the Reverse Stock Split Certificate of Amendment. Pursuant to the Reverse Stock Split Certificate of Amendment, the Reverse Stock Split became effective as of 4:06 p.m. Eastern Time on July 1, 2025. As a result of the Reverse Stock Split, every ten (10) shares of Common Stock were exchanged for one (1) share of Common Stock. The Common Stock began trading on the NYSE American on a split-adjusted basis at the start of trading on July 2, 2025.

The Reverse Stock Split did not affect the total number of shares of capital stock, including the Common Stock, that the Company is authorized to issue, which remains as set forth pursuant to the Articles of Incorporation, as amended. No fractional shares of Common Stock were issued in connection with the Reverse Stock Split. Any holder that would receive a fractional share of Common Stock as a result of the Reverse Stock Split will automatically be entitled to receive an additional remaining fraction of such share of Common Stock in order to round up to the next whole shares as of the date of the Reverse Stock Split. The Reverse Stock Split also has a proportionate effect on all other options and warrants of the Company outstanding as of the effective date of the Reverse Stock Split.

The new CUSIP number for the Common Stock is 171126 204.

24

The Company’s transfer agent, Nevada Agency and Transfer Company, is acting as exchange agent for the Reverse Stock Split.

Departure and Election of Directors

In connection with the Merger and pursuant to the terms of the Merger Agreement, at the Effective Time, Francis Knuettel II, Todd Davis, Ezra Friedberg and Chia-Lin Simmons each resigned from the Company’s board of directors (the “Board”).

In addition, the size of the Board was increased from five to seven directors.

At the Effective Time, one director selected by the Company, namely Dr. Richard Malamut, one director who is the newly-elected Chief Executive Officer of the Company, namely Scott Plesha, four directors selected by LNHC, namely Peter Greenleaf, Matthew Pauls, Todd Davis and Richard Baxter, and one member selected by Nomis Bay, namely Ezra Friedberg, were each appointed to serve as a director of the Company until the next annual meeting of stockholders to be held after the Closing Date or until a successor is duly elected and qualified, or until each such director’s earlier resignation or removal.

Effective as of the Closing Date, the following committees of the Board were constituted as follows:

| ● | Audit Committee: Ezra Friedberg (Chair) and Matthew Pauls. |

| ● | Compensation Committee: Dr. Richard Malamut and Matthew Pauls (Chair). |

| ● | Nominating and Corporate Governance Committee: Dr. Richard Malamut and Peter Greenleaf (Chair). |

Departure and Appointment of Certain Officers

In connection with the Merger, on the Closing Date, Francis Knuettel’s employment as Chief Executive Officer, and President, Treasurer and Secretary of the Company terminated.

Additionally, on the Closing Date, Dr. Eric Lang’s employment as Chief Medical Officer of the Company was terminated.

The Company’s directors and the foregoing named officers have entered into customary indemnification agreements that provide them, in general, with customary indemnification in connection with their service to the Company or on its behalf.

On the Closing Date, the Company entered into employment agreements with Messrs. Plesha, Knuettel and Rangarao effective as of the Closing Date.

Amended and Restated 2023 Plan

On April 16, 2025, the Company’s stockholders approved the Channel Therapeutics Corporation Amended and Restated 2023 Plan (the “Amended and Restated 2023 Plan”). The Amended and Restated 2023 Plan is intended to encourage key employees, directors, and consultants of the Company and its subsidiaries to continue their association with the Company by providing favorable opportunities for them to participate in the ownership of the Company and its subsidiaries and in its future growth through the granting of equity ownership opportunities and incentives based on Company Common Stock that are intended to align their interests with those of the Company’s stockholders. The Amended and Restated 2023 Plan reflects amendments to the 2023 Plan, which, among other things, (i) increases the number of shares of Common Stock that are authorized to be issued under the 2023 Plan from to and (ii) provides for a termination date of April 11, 2035.

25

Kopfli Matter

On

February 14, 2024, the Company’s board of directors received a demand letter from an attorney representing Chromocell Holdings

and its former Chief Executive Officer and former Chief Strategy Officer, Mr. Christian Kopfli, who was released for “cause.”

Mr. Kopfli alleged an improper termination for “cause” and claimed to seek monetary damages in the amount of $

By

Order dated October 3, 2024, the court in the New York Action awarded the Company a default judgment against Mr. Kopfli and Chromocell

Holdings on all claims. On July 25, 2025, following an inquest held before the court regarding the Company’s damages, the

court entered an order (i) holding that the Company (identified in the order as Chromocell Therapeutics Corporation) is entitled

to damages against Mr. Kopfli and Chromocell Corporation, jointly and severally, in the amount of $, as well as additional

damages against Mr. Kopfli in the amount of $

26

Lang Demand Letter

On

July 24, 2025, the Company received a demand latter (the “Lang Demand Letter”) from an attorney representing Dr. Eric

Lang, the former Chief Medical Officer of the Company. The Lang Demand Letter asserts that the Company breached Dr. Lang’s

employment contract with the Company and violated Dr. Lang’s rights under New Jersey wage and hour laws and the federal

Consolidated Omnibus Budget Reconciliation Act (“COBRA”). The Lang Demand Letter asserts potential liability of as

much as $

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Cautionary Notice Regarding Forward Looking Statements

This Quarterly Report on Form 10-Q (this “Report”) contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Forward-looking statements discuss matters that are not historical facts. Because they discuss future events or conditions, forward-looking statements may include words such as “anticipate,” “believe,” “estimate,” “intend,” “could,” “should,” “would,” “may,” “seek,” “plan,” “might,” “will,” “expect,” “predict,” “project,” “forecast,” “potential,” “continue,” negatives thereof or similar expressions. These forward-looking statements are found at various places throughout this Report and include information concerning possible or assumed future results of Pelthos Therapeutics Inc.’s (“Pelthos”, the “Company”, “our”, “us” or “we”) operations; business strategies; future cash flows; financing plans; plans and objectives of management; any other statements regarding future operations, future cash needs, business plans and future financial results, and any other statements that are not historical facts.

From time to time, forward-looking statements also are included in our other periodic reports on Form 10-K, 10-Q and 8-K, in our press releases, in our presentations, on our website and in other materials released to the public. Any or all of the forward-looking statements included in this Report and in any other reports or public statements made by us are not guarantees of future performance and may turn out to be inaccurate. These forward-looking statements represent our intentions, plans, expectations, assumptions and beliefs about future events and are subject to risks, uncertainties and other factors, including risks related to market, economic and other conditions; our current liquidity position, the need to obtain additional financing to support ongoing operations, Pelthos’s ability to continue as a going concern; Pelthos’s ability to maintain the listing of its Common Stock on the NYSE American LLC, Pelthos’s ability to manage costs and execute on its operational and budget plans; and, Pelthos’s ability to achieve its financial goals. Many of those factors are outside of our control and could cause actual results to differ materially from the results expressed or implied by those forward-looking statements. In light of these risks, uncertainties and assumptions, the events described in the forward-looking statements might not occur or might occur to a different extent or at a different time than we have described. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this Report. All subsequent written and oral forward-looking statements concerning other matters addressed in this Report and attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this Report.

Except to the extent required by law, we undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events, a change in events, conditions, circumstances or assumptions underlying such statements, or otherwise.

Overview

Prior to the Merger outlined above, we operated as a clinical-stage biotech company focused on developing and commercializing new therapeutics to alleviate pain. Following the Merger, we are focused, though not necessarily to the exclusion of the original programs, on the commercialization of Zelsuvmi.

27

Our pre-Merger programs selectively target the sodium ion-channel known as “NaV1.7”, which has been genetically validated as a pain receptor in human physiology. A NaV1.7 blocker is a chemical entity that modulates the structure of the sodium-channel in a way to prevent the transmission of pain perception to the central nervous system (“CNS”). The goal of the pre-Merger programs is to develop a novel and proprietary class of NaV blockers that target the body’s peripheral nervous system.

There are three pre-Merger programs developing pain treatment therapeutics, all of which are based on the same proprietary molecule, as follows:

Eye Pain: Based on a novel formulation of CC8464, its Eye Pain program, titled CT2000, is for the potential treatment of both acute and chronic eye pain. NaV1.7 channels are present on the cornea, making it a viable biological target for treating eye pain. Eye pain may occur with various conditions, including severe dry eye disease, trauma and surgery. Existing therapies for eye pain (such as steroids, topical non-steroidal anti-inflammatory agents, lubricants, local anesthetics) are limited in their effectiveness and/or limited in the duration that they may be prescribed because of safety issues. Pelthos intends to explore the viability of developing CT2000 as a topical agent for the relief of eye pain. A potential advantage of this approach is that topical administration of CT2000 is unlikely to lead to any hypersensitivity or skin reactions, like what was noted with systemic administration of CC8464, because the systemic absorption from a topical administration would be extremely limited. Pelthos has developed topical ophthalmic formulations and are pursuing trial plans as set forth below.

Current options for the treatment of ocular pain center on the use of corticosteroids and non-steroidal anti-inflammatory drug (“NSAID”) based therapeutics. These options suffer from sight-threatening complications such as Glaucoma and corneal melting, thus there is a large unmet need for other approaches. As an example of the potential patient population, Pelthos estimates that there are approximately 5 million cases of corneal abrasions per year in the United States. In addition, other potential indications associated with eye pain include:

| ● | severe dry eye, |

| ● | side effects from photorefractive keratectomy (PRK) and pterygium surgery, |

| ● | second eye cataract surgery, |

| ● | neuropathic corneal pain, and |

| ● | severe uveitis and severe iritis/scleritis. |

As NaV1.7 channels are present on the cornea and is a viable biological target for treating eye pain, Pelthos believes that it has a sound scientific basis for its ability to treat a multitude of eye pain indications. It has successfully developed an eye drop formulation and has determined that the eye drops are well tolerated by animals.

28

Pelthos has two completed animal efficacy studies and are in the process of completing pivotal IND enabling ophthalmic toxicology studies. The efficacy studies are as follows:

Trial One

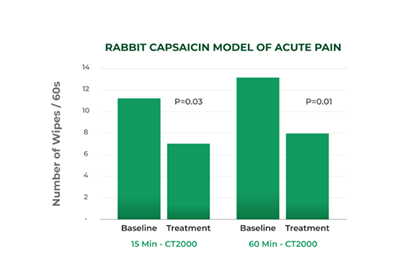

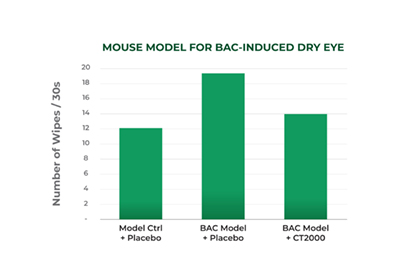

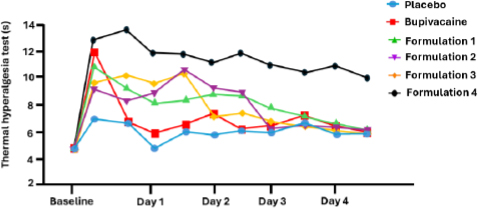

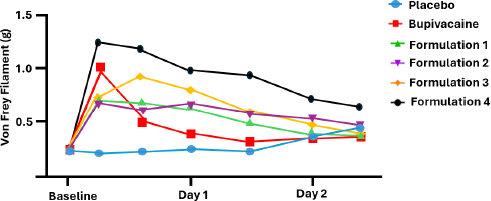

In the first trial, rabbits were treated with capsaicin (i.e., Pepper spray) to mimic an acute ocular insult in a common, validated model for acute eye pain studies. Following the capsaicin treatment, the rabbits were treated with CT2000, which was dosed four times over a 24-hour period. Pain was measured by the number of paw wipes over 60 seconds (paw wipes are a recognized surrogate of eye pain in animal models). The results showed that CT2000 significantly reduced the number of paw wipes within 15 minutes of administration of capsaicin and that CT2000 continued to show efficacy over a 60-minute period following administration. This eye pain model was only validated for a short duration, with the results summarized in the following graph:

Trial Two